Q&A

Insurance and Financial Planning

I’ve been very happy with my car insurance through State Farm, but I recently bought a rather expensive kayak. You don’t insure those, do you?

Would you believe we do? There are many ways to get from Point A to Point B and State Farm is happy to insure your jet skis, trail bikes, truck campers, golf carts, and kayaks. We understand these items can represent a big investment and State Farm has you covered—whatever you drive—in more ways than one. We offer great savings options and attentive service. Plus, your coverage can be personalized, to include things like Emergency Roadside Service (ERS) coverage and car rental insurance. I’ve been in the insurance industry for 45 years. State Farm is the gold standard for customer service and stellar coverage. That’s why I opted to exclusively be a State Farm Insurance and Financial Services agent. And I’ve never looked back.

My husband and I recently bought our first home. American dream, here we come. How do we know how much insurance is enough?

Congratulations, that’s an exciting step. Homeownership is a lot of responsibility. It’s important to make sure your home and the possessions within are protected in the event of unexpected damage or catastrophe. You also want to have liability insurance in case someone stumbles and falls on your property. It’s time to sit down with an experienced insurance agent and let them advise you on the best coverage for you.

How often should we reassess that coverage?

Many people purchase homeowners insurance or renters insurance when they first move into their new home then pay little attention to their policy after that. That’s a mistake because over time, as you make renovations, purchase new items, or replace existing appliances, you may be leaving gaps in your coverage. It’s wise to sit down annually with your insurance agent to review your coverage. During that meeting, ask about discounts, review home renovations, discuss landscaping changes, share any changes in the appliances, and confirm that your home is insured for the estimated cost to rebuild. And if you combine your home and auto insurance, consider reviewing your auto coverage at the same time.

What’s the best age to retire?

The answer is different for everyone. My goal early in life was to plan my finances so I could retire comfortably by the time I was 55. Through saving, budgeting, and investing, I did achieve that goal. Then I realized I enjoy working on my business, working with people, and making a difference in their lives. Like me, not all of my clients want to retire at 65. But it’s my job to help them get to the point where they can if they want to. An experienced financial advisor can help you sort through all the factors that go into making a wise decision about when to retire. You’re never too young to partner with that advisor and begin preparations for the retirement you want—whenever that is.

About The Expert

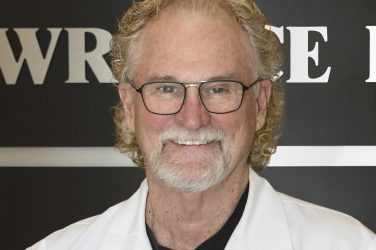

Al Clark

State Farm Insurance

Al Clark is a national award-winning insurance agent and experienced financial advisor. For 45 years, Al has built one of the most successful State Farm Insurance and Financial Service offices in the country as he has helped his Tarrant County neighbors protect their families and possessions and realize their financial dreams.