Q&A

Financial Advisor

What is a fiduciary advisor and what are the benefits to working with one?

A fiduciary advisor is a financial professional who is legally obligated to act in your best interest. Just like your doctor’s main concern is your health, a fiduciary advisor’s primary concern is your financial health and security. As a fiduciary advisor, I’m morally, ethically, and legally bound to work for my clients’ best interests.

What sets OpenAir Advisers apart from other wealth management providers in terms of expertise, resources, and client experience?

We tailor everything. We don’t provide cookie-cutter guidance — it’s all customized to each client. When we first meet with people, we go through a list of questions to get to know them. It’s a risk questionnaire so we learn the level of risk they feel comfortable with. We talk about things they’ve accomplished and still want to accomplish so we can prioritize their goals in retirement. We’re also regularly involved with our clients. We host lunch-and-learns, where we talk about market conditions. We offer regular Q&As where people can come in and get their questions answered and just have conversations with us.

How often should I meet with a money manager or financial advisor?

It’s different for everybody. Some people benefit from meeting quarterly or twice a year. Some people benefit from meeting more frequently. For example, if someone is 65 and thinking about retiring, they might want to meet more often. I joke sometimes that I’m somewhat of a therapist for my clients. Many people get fearful as they approach retirement. They worry if they’ll have enough. So, it’s helpful for those clients to meet more often and have more regular check-ins. Feel free to book an introductory call with me at OpenAirAdvisers.com and we can talk about your goals.

In the current economic environment, is it better to invest extra money or make additional mortgage payments?

It depends on several factors. For example, if you have a mortgage interest rate of 3%, making additional mortgage payments may not make sense. You might be better off investing that money, especially if you can get higher rates on savings accounts. It’s a mistake to take money out of a retirement account to pay off your mortgage early. This is because you’re withdrawing money from an account you’ve never paid taxes on. So, withdrawals are taxed at 10 to 20% or more just to pay off a 3% interest debt.

What is your investment philosophy and how does it align with my goals and risk tolerance?

My investment philosophy revolves around crafting personalized strategies that align closely with your specific goals and risk tolerance. I prioritize getting to know you and understanding your financial aspirations. Whether you’re saving for retirement, planning for your children’s education, or aiming for other milestones, I tailor our investment strategy to reflect what matters most to you. Ultimately, my goal is to empower you with a thoughtful and strategic investment plan that reflects your unique circumstances and aspirations.

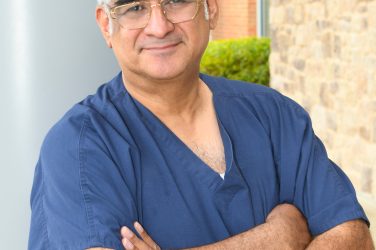

About The Expert

Chris Massenburg, CRPC

OpenAir Advisers

Chris Massenburg, CRPC is a managing partner, fiduciary, and Chartered Retirement Planning Counselor with more than 15 years of experience. He serves his clients’ financial planning needs by working to manage their wealth responsibly, grow it tax efficiently, and evaluate it for years to come.