Q&A

Financial Advisor

Let’s start with your foundation of retirement planning first. How can I protect some of my retirement funds from market volatility and loss?

The current uncertainty in the marketplace may open the door to considering options for the preservation and protection of your funds from a downside market. We can also explore providing a source of guaranteed lifetime income. At Andrews Financial Services, we ask questions and listen to your concerns and plans. Our goal is to help you navigate the choices in the marketplace for investing your retirement funds. After our discussion, we will help you create a flexible, personalized strategy to move toward your goals. If you are already retired, we can discuss ways you may be able to improve your income.

We get many questions as to why or why not annuities should be considered as part of your retirement income sources.

There are different types of annuities to consider, based on the market risk you are comfortable with. Annuities are an important financial option, offering a guaranteed income source you cannot outlive. We can review how annuities may complement your long-term income planning, when blended with other types of investments.

How will my money grow if I’m on a fixed income?

Financial growth is determined by the type of investments you have and the income these investments may provide. Spending 30 to 45 minutes with us will allow a review of your investments and options to consider for increasing your current and/or future income.

How can I create a more tax-effective plan for retirement?

Our initial meeting will include a review of your statements, assess your current risk and fees, prioritize your goals, and consider investment choices to minimize and reduce your risk where needed. Defining your comfort level with the market risk of your investments, can determine how emotionally comfortable you are with your invested money and whether you want more stability or growth with market risk.

When is a good time to review my retirement account?

Now is the BEST TIME for a financial review! I suggest scheduling a complimentary consultation. When we meet, we will discuss market risk, fees, and hear your goals if you are retired now, or planning for retirement. I look forward to meeting you!

Investments in securities may not offer a fixed rate of return. Principal, yield and/or share price may fluctuate with changes in market conditions and when sold or redeemed, you may have more or less than originally invested. No system or financial planning strategy can guarantee future results. Annuities may impose a surrender charge during the initial years of the contract. Withdrawals prior to 59 ½ may result in a 10% tax penalty in addition to ordinary income tax. The guarantee of the annuity is backed by the claims paying ability of the issuing Insurance Company.

About The Expert

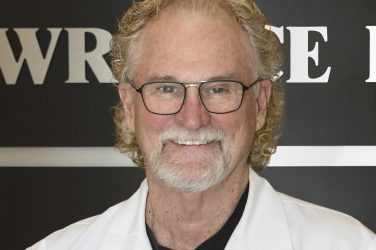

Debbie Andrews

Andrews Financial Services

Debbie Andrews is the Owner and President of Andrews Financial Services and is celebrating 35 years in helping clients accumulate wealth and reduce taxes. She is a licensed financial advisor specializing in retirement and income planning including managed accounts, mutual funds, stocks, bonds, annuities, and life insurance plan design. Securities and Advisory services are offered through Cambridge Retirement Research, Inc., a broker-dealer, member FINRA/SIPC, Investment Advisor Representative. Fixed insurance offered through Andrews Financial Services.