Q&A

Financial Advisor

What does it mean to be a dually-registered financial advisor and what are the advantages to working with one?

A dually-registered financial advisor is registered both as a broker-dealer representative and as an investment advisor representative. This allows them to offer a wide range of financial products and services, including securities brokerage services as well as personalized investment advice, financial planning, and asset management.

Working with a dually-registered financial advisor provides clients with access to a broader range of financial products and services tailored to their individual needs and goals. Whether they require investment advice, retirement planning, insurance solutions, or assistance with estate planning, I can offer comprehensive solutions that align with their financial objectives.

How do you determine whether to recommend brokerage services or investment advisory services to your clients?

The decision to recommend brokerage services or investment advisory services depends on each client’s unique situation, preferences, and financial goals. I conduct a thorough assessment of their financial situation, risk tolerance, investment objectives, and time horizon to determine the most suitable approach. I then discuss the available options with my clients and work together to develop a personalized strategy that meets their needs.

How do you stay informed about changes in regulations and industry trends relevant to both brokerage and advisory services?

Staying informed about regulatory changes and industry trends is essential in my role as a dually registered financial advisor. I regularly participate in continuing education programs, seminars, and workshops to stay up to date on the latest developments. Additionally, I closely monitor regulatory updates from relevant governing bodies and seek guidance from compliance experts to ensure compliance with all applicable laws and regulations.

How do you prioritize honesty and transparency in your role as a financial advisor?

I’ve noticed that, surprisingly, most people we see don’t ask how we are paid. I’m often the first to broach the topic when I bring it up in a first or second meeting. Honesty and transparency are foundational principles of my practice, so I make sure to clearly explain how people like me are paid and what clients should watch out for. This means disclosing all relevant information, including potential risks and conflicts of interest, so that my clients can make informed decisions about their financial future.

What if a client has further questions and needs answers that are free from jargon or complex financial language?

Effective communication is key to building trust and fostering productive client-advisor relationships. I encourage questions and feedback, and I take the time to ensure that my clients understand the information and recommendations I provide. I also strive to communicate with my clients in a clear, straightforward manner, avoiding technical language. By prioritizing clear communication, I empower my clients to make informed, confident financial decisions.

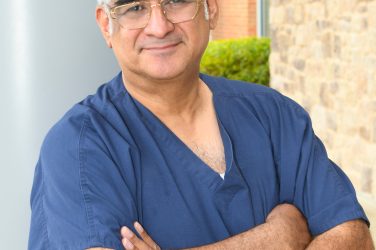

About The Expert

Trace Dennis

Jal Dennis Group Investment Services

All locally based and specialized in separate aspects of financial planning, the advisors at Wylie’s Jal Dennis Group make the office an agile powerhouse in their field. Principal at the firm, United States Marine Corps veteran Trace Dennis holds a Bachelor of Business Administration in accounting from the University of New Mexico.

Securities offered through LPL Financial Member FINRA/SIPC.