Q&A

Who Should Consider Hiring A Financial Adviser?

Anyone who wants to achieve financial goals, build wealth, and secure their financial future should consider an adviser. Whether you are starting your career, planning for retirement, or looking to pass wealth to future generations, a financial adviser helps you create a financial plan that meets those needs. My process involves having consultations to answer this question. If you’re considering hiring an adviser, visit OpenAirAdvisers.com to schedule a complimentary consultation.

What Does A Financial Adviser Do?

A financial adviser is a professional who helps individuals and businesses manage their financial resources to achieve their financial goals. We offer expert advice on investments, retirement planning, taxes, estate planning, insurance, and other financial matters. The goal is to offer personalized financial planning services tailored to specific needs and goals. Many people focus on the cost versus the value of having a financial adviser in their corner. A Vanguard study said having a financial adviser can benefit you as much as 3% a year toward your total investment strategies by rebalancing portfolios, thinking about tax minimization strategies, investment management, etc.

What Should I Look For In A Financial Adviser?

Credentials are important. This includes Certified Financial Planners (CFP), Chartered Retirement Planning Counselor (CRPC), and Chartered Financial Analyst (CFA). Beyond that, experience is important. And then, you want to look at whether they are fiduciary. Many financial advisors work for big broker-dealers with suitability standards versus fiduciary standards. The analogy we give is if you buy a suit off the rack, could it fit? Yes. Could it look okay? Yes. But wouldn’t you buy a suit and have it tailored specifically to you? A good financial plan is like a Rubik’s cube; you can’t move one piece without thinking about how it will affect the rest of your plan. You want a financial adviser who looks at every area of your plan to ensure they’re working together.

How Do You Reduce Client Risk?

We look at the overall risk assessment of your risk tolerance and what’s applicable to where you are at that stage in your life. You also must combine that with economic risk. That leads to a total risk management score of where you should be. We don’t want you to be too far out of risk at the wrong time. Everyone is unique. That’s why it’s important to tailor each approach to each client.

What’s The No. 1 Concern Clients Have?

Taxes are something we’ve considered in our planning, and the hard fact is they will likely be higher in the future. With the national debt climbing and spending not slowing down, the government has to increase its income. Raising taxes is the only way to do that. A big part of planning for retirees is being as efficient as possible with income planning and strategies to reduce future tax liabilities. I make sure we have the right types of investments in the correct taxable account and that we are drawing income in the most efficient way.

About The Expert

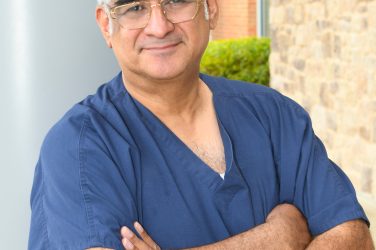

Chris Massenburg

OpenAir Advisers

A native of Rockwall with 15 years of experience in financial planning, Chris Massenburg helps clients reach their financial goals through sound financial planning and thoughtful, diversified portfolios. As a fiduciary and Chartered Retirement Planning Counselor, he believes a foundation of transparency and trust is key to a successful client-adviser partnership.